For the last two years, Tesla has released its third quarter results on November 2, so we can expect to see the third quarter results in just a few weeks. Our team looked at the Watchdog Report to get some insight on what issues could come up in that report.

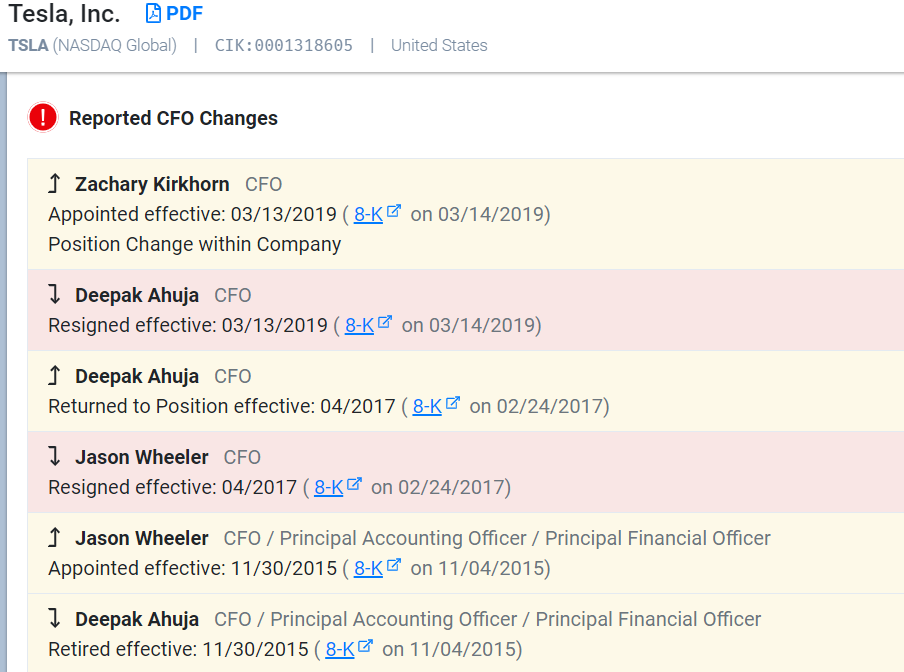

One thing that sticks out in the Watchdog Report for Tesla is a red flag for reported CFO changes. Just last year, we pointed out that Tesla had an unusual red flag; it was the only company that had brought back a CFO on a permanent basis after their retirement. This event was not only unusual, it was unique, and therefore raised concerns.

Well, Deepak Ahuja’s reinstatement wasn’t permanent, he resigned again two-years later this March and has handed over the reins of the company to Zachary Kirkhorn, a 34-year-old, who has worked at Tesla since 2010 (although he did depart for two years to get a MBA from Harvard). A brief look at the Watchdog Report show the timeline of all these disruptive changes.

There has been plenty of turmoil at the executive level in Tesla’s recent history. It is well known that Musk agreed to step down as the chairman of the board at Tesla for 3 years as a part of a settlement with the SEC over a tweet Musk made claiming he had secured funding to take the company private. Additionally, in April, four of Tesla’s directors declined to stand for reelection.

Common sense tells us that all this turmoil is a sign of a deeper disfunction that will manifest itself in a variety of other ways. But our team wanted to go further and provide some way of quantifying that risk.

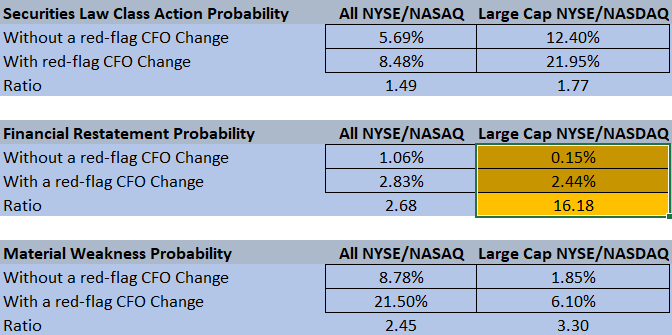

Our analysts have a two-tier flag system for executive changes, yellow and red. Our system marks any CFO change with a red flag if it either comes shortly after either a CEO or a CFO change, or if there was a dismissal for cause. Our team looked back at ten years of data to compare the likelihood of a class action suit, material weakness, or restatement occurring in the year when there was red flag CFO change, as well as the likelihood of those events occurring without one. We first looked at the data for all companies, then narrowed those results to focus on large cap companies because they are a better peer group for Tesla. Here are our results:

*we highlighted the large cap numbers for restatements in orange because they are unreliable due to the paucity of observations.

As we can see in all instances, a red flag CFO change makes it more probable that a company will also have a class action suit, a material weakness, or even a restatement. The chance of having a material weakness more than triples for large cap companies, and the overall chance of a class action lawsuit rises to over 20%.

These statistics are helpful, but they do not really capture the whole story either. Normally a red flag is raised when there are two CFO changes in a short period of time, here Tesla has changed their CFO three times in the last four years. The other important fact to remember is that Zachary Kirkhorn is only 34 years old and has worked for Tesla since he was 25, except for two years he spent getting his MBA.

Will he be an independent voice, an advocate for transparency, and provide steady leadership? Or will he be a yes-man, who ends up being a scapegoat for litigation, material weaknesses, or even a financial restatement like David Knopf at Kraft Heinz?

We hope for his sake that Zachary is a complete success, but it is looking like the odds are stacked against him.

We have plenty more to say about Tesla, stay tuned…

Read the Report for Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284.